The attacks in the Red Sea, which started over 150 days ago, have caused widespread disruption to the ocean shipping industry. Our notifications are designed to provide you with an overview of recent events (based on established market intelligence tools, reliable news platforms and our discussions with shipping lines and airlines) and the associated commercial and operational impacts.

Latest development

Yemen’s Houthis said on Tuesday that they had mounted six attacks on ships with drones and missiles in the last 72 hours in the Gulf of Aden and the Red Sea. The Houthis attacked the Maersk Saratoga, APL Detroit, Huang Pu and Pretty Lady after identifying them as either US or British, according to a statement from the group’s military spokesperson Yahya Sarea. (Source: Houthis say six ships attacked in past 72 hours)*

As the US military continues to strike Houthi targets in Yemen in retaliation for the group’s repeated attacks on commercial ships in the Red Sea, the Iran-backed group renewed its threats against any country that gets involved in attacking Yemen.

In an interview with the Houthi-run Al-Masirah television channel aired on Sunday, Mohammed Ali al-Houthi, a member of the group’s Supreme Political Council, said: “We renew our warnings that any country that would act against our country would make its interests a legitimate target for us,” he threatened. (Source: Houthis warn Saudi Arabia ‘it would be a target’ if it backs US-UK strikes)

After recent reports that the Houthis would not target Russian or Chinese owned vessels, a Chinese owned tanker was hit in a missile attack by the Houthis. Perhaps as has appeared to have been the case previously, the Houthis have based target decisions on old ownership information. (Source: Houthis Fired Missile at Chinese-Owned Ship in Red Sea, US Says)

*Comment from Bertling: We are still reviewing this news update and its impact to the ship

Impact on freight rates

Container (no changes since last report from 12.03.2024)

From a purely commercial perspective of container shipping: Service from the Far East to destinations in the Mediterranean Sea, Northern Europe and US East Coast, are now running fairly smoothly around the cape of good hope. And freight rates have declined since mid-Jan. To the extent of 15-20% since then as per Xeneta's real-time market data and benchmarking platform. (Source: xeneta.com).

Breakbulk

A major carrier has recently upped the War Risk. AAL continues to operate multipurpose heavy lift sailings through the Red Sea/Gulf of Aden region.

Following notification of a further, significant increase in insurance premiums required for these sailings - with risk levels elevated – AAL are increasing their ‘Emergency Red Sea Surcharge’ (ERSS) with immediate effect for all forthcoming sailings through the region to USD 10.00 per R/T (increased from USD 5 per R/T).

An increase in the multipurpose vessel index (MPP Index) has been partly attributed due to the Red Sea situation. (Source: Red Sea circumnavigation bumps MPP Index up in March (projectcargojournal.com)

While the Red Sea situation remains volatile, we can expect carriers to take evasive action at any time.

Airfreight

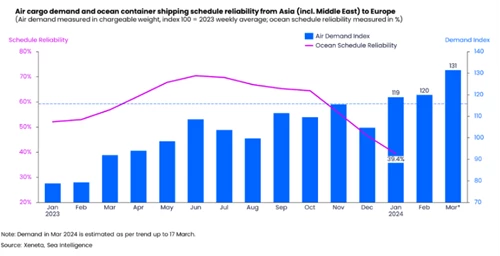

Contrary to the usual seasonal downturn, the average global air cargo spot rate in the first two weeks of March increased by 3% month-on-month from February, at USD 2.35 per kg.

This rise in the average global air cargo spot rate occurred despite a drop in jet fuel spot prices.

Shippers continue to turn to air cargo due to unreliability in ocean freight services. The market is once again experiencing a shift in transport mode, this time around the disruption has been caused by ongoing conflict in the Red Sea. However, the impact of the Red Sea incident and uptake on air freight remains limited. Customers are increasingly looking at multimodal transport solutions such as sea-air logistics. Capacity constraints may become an issue for this solution.

SURCHARGES (no changes since last report from 12.03.2024)

Diversions away from the Suez Canal have hit ocean freight trades hard from Asia to the Mediterranean, North Europe and US East Coast. However, it could be argued cargoes moving in the opposite direction on the backhauls have been hit even harder by these surcharges.

Effect - North Europe to Far East.

Moving from USD 400 per FEU by the end of 2023 to more than USD 1,000 per FEU by mid-February, market average spot freight rates have gone up by 150% in six weeks.

Within these market average spot rates, some shippers have been paying upwards of USD 1,000 in additional costs while others have managed to avoid surcharges altogether, with an average of USD 591 per FEU.

Effect – Mediterranean to Far East

Surcharges are spread in the range of USD 400 (mid-low) and USD 1,100 (mid-high) per FEU, with an average of USD 639.

Effect – North Europe to Australia and New Zealand

Shippers and BCOs are paying average surcharges of USD 854 per FEU within a total spot rate of USD 2,400 per FEU. This positions the trade slightly above a classic backhaul and slightly below a classic fronthaul in terms of the total spot rate and percentage of surcharges to overall cost.

Wide-ranging effects

The effects of the crisis are highly individual, and shippers, carriers, and freight forwarders are fighting as hard as they can and entering negotiations with the single aim of reducing the effect of the crisis on their business as much as possible – whether that is through surcharges or service reliability.

Surcharges are more significant on long-term rates

For a standard FEU, the Red Sea surcharge for exports out of the Mediterranean on long term contracts sits higher than North European exports, with a spread of USD 162. However, while the market low for both trades sits at USD 400, the market high sits at USD 1,295 for the Mediterranean and USD 750 for North Europe. Bringing a reefer out of North Europe heading for Far East, the average surcharge sits at USD 1,007 per box.

Impacts on shipments/traffic/congestion

With nearly 90% of global trade relying on sea routes, the Red Sea’s significance cannot be overstated. The Suez Canal, a vital link connecting Asia and Europe, typically handles 12% of global trade, facilitating the transportation of a wide array of goods, including electronics, machinery, oil, gas, and automobiles.

Currently 92% of container ships which would ordinarily transit the Suez Canal are avoiding the area due to the risk of attack from Houthi Militia.

The conflict is impacting maritime supply chains beyond container ships. Just 30% of the usual shipping capacity is transiting the Suez Canal, which also includes bulk carriers, car carriers and tankers carrying oil and liquified natural gas.

(Source: Another wake-up call for the world - International Trade Magazine)

A little out of context but still relevant for further tension in already stressed supply chains:

The Francis Scott Key Bridge in Baltimore has collapsed after it was struck by a container ship on 26 March 2024. Emergency responders have declared a mass casualty event, and a multiagency rescue operation is under way for people who entered the water.

While Baltimore is not one of the largest US East Coast ports, it still imports and exports more than one million containers each year so there is the potential for this to cause significant disruption to supply chains. Far East to US East Coast ocean freight services have already been impacted by drought in the Panama Canal and recent conflict in the Red Sea, which saw rates increase by 150%, so this latest incident will add to those concerns.

(Source: https://www.xeneta.com/news/xeneta-industry-newsfeed)

OUTLOOK

We don’t see the Red Sea situation changing any time soon and the above-mentioned trends are likely to continue into H2 2024.

Our advice

This ongoing crisis will continue to impact rates and increase service unreliability to global supply chains. It is important to stay up to date, book well in advance, potentially look for alternatives and contact us on time to discuss your transport inquiry.

We commend our customers to be flexible in these times of uncertainty. They need to have the ability to enter the North American market from different endpoints, be it the West Coast, Gulf, or the East Coast via vessel or also considering airfreight as alternative transport modes.

We are here by your side to keep your supply chains moving and identifying the most suitable mode and route for your cargo transport. Contact your local Bertling office for further updates: https://www.bertling.com/offices/.

Let's connect to stay informed

For air freight inquiries:

Janine Seemke

Global Head of Airfreight

P: +49 40 32335554M:+49 173 3893139

E: janine.seemke@bertling.com

For sea freight inquiries:

Samuel Semple

Group Pricing Manager – Ocean Freight (FL)

P: +49 40 3233550M:+49 1732069897

E: samuel.semple@bertling.com