The attacks in the Red Sea have caused widespread disruption to the ocean shipping industry. Our notifications are designed to provide you with an overview of recent events (based on established market intelligence tools, reliable news platforms and our discussions with shipping lines and airlines) and the associated commercial and operational impacts.

LATEST DEVELOPMENTS

Houthi attacks on merchant vessels continued over the past week as attacks on Houthi sites in Yemen also continued. Houthis have vowed to escalate their targeting of vessels in the region. The UN has also weighed in now on the economic and environmental impacts of the conflict in the region. (Source: Houthis vow to escalate attacks - Splash247)

There have been 48 Houthi attacks (status 20.02.2024) on commercial shipping since 19.11.2023 with no end in sight. (Source: Red Sea crisis and peak season - do you have a container plan? - FreightWaves)

Despite multiple strikes by the U.S. and allies against rebel targets, Houthis have warned that their attacks "will continue until the aggression against Gaza stops.” (Source: Maersk says Red Sea vessel diversions could go into second half of year (ampproject.org)

Impacts on Freight Rates

Container

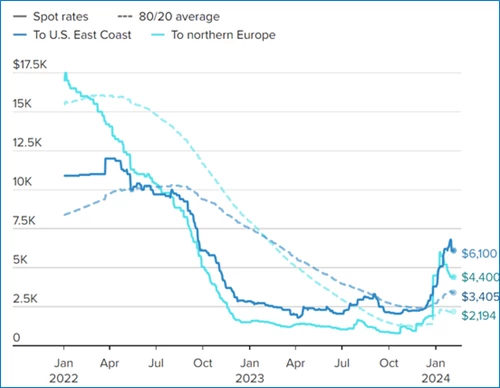

The higher freight rates may be pulling off their Red Sea highs, according to recent data from Xeneta, but Far East to East Coast rates are up 145.5% since Dec. 14 and Far East to West Coast rates have increased by 186.2% in the same time frame. If containers start to get tight, rates will only go higher (Source: https://freightwaves.com).

Container Shipping Rates from North Asia to the USA and Europe (40’ containers):

(Source: https://cnbc.com)

US companies in particular are faced with three supply chain headwinds: Red Sea diversions, East Coast port labour negotiations, and the Panama Canal drought. Shippers are looking for alternatives to cut both the time and rising cost of transit.

Breakbulk

Breakbulk liner carriers continue to operate sailings through the Red Sea/Gulf of Aden region. However, there remains increased insurance premiums required for these sailings, commonly implemented as a War Risk surcharge or Emergency Red Sea Surcharge (ERSS) at plus USD 5 per RT (subject to review).

Whilst the situation in the Red Sea remains volatile, sailings may be diverted at short notice via Cape of Good Hope (COGH) adding to cost and transit time. Vessels from Far East to US Gulf are already commonly sailing around COGH due to Panama Canal low water issues.

Airfreight

The Red Sea crisis (and also the recent Lunar New Year holidays) has impacted some trades, such as Vietnam to Europe. Manufacturers are experiencing halted production or product delays due to disruptions in the ocean freight market. Time-sensitive shipments are switching to air freight due to the ocean freight sector.

Airfreight rates began their Lunar New Year holiday decline last week after rising in the first six weeks of the year. The rest of the year has so far been marked by a strong rise in airfreight rates as the industry faced the usual pre-Lunar holiday rush and some shippers utilized sea-air solutions to combat the delays caused by the Red Sea crisis. Rates are expected to stabilize in Q2 2024. (Source: https://www.aircargonews.net/airlines/airfreight-rates-slide-in-line-with- -new-year-holiday-demand-decline/).

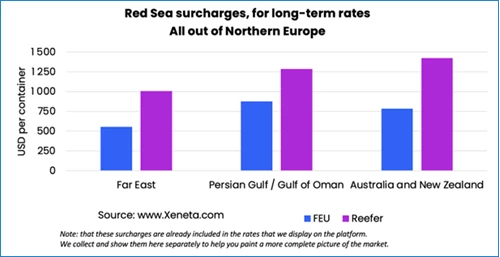

SURCHARGES

Diversions away from the Suez Canal have hit ocean freight trades hard from Asia to the Mediterranean, North Europe and US East Coast. However, it could be argued cargoes moving in the opposite direction on the backhauls have been hit even harder by these surcharges.

(Source: https://www.xeneta.com)

Effect – North Europe to Far East.

Moving from USD 400 per FEU by the end of 2023 to more than USD 1,000 per FEU by mid-February, market average spot freight rates have gone up by 150% in six weeks. Within these market average spot rates, some shippers have been paying upwards of USD 1,000 in additional costs while others have managed to avoid surcharges altogether, with an average of USD 591 per FEU.

Effect – Mediterranean to Far East

Surcharges are spread in the range of USD 400 (mid-low) and USD 1,100 (mid-high) per FEU, with an average of USD 639.

Effect – North Europe to Australia and New Zealand

Shippers and BCOs are paying average surcharges of USD 854 per FEU within a total spot rate of USD 2,400 per FEU. This positions the trade slightly above a classic backhaul and slightly below a classic fronthaul in terms of the total spot rate and percentage of surcharges to overall cost.

Wide-ranging effects

The effects of the crisis are highly individual, and shippers, carriers, and freight forwarders are fighting as hard as they can and entering negotiations with the single aim of reducing the effect of the crisis on their business as much as possible – whether that is through surcharges or service reliability.

Surcharges are more significant on long-term rates

For a standard FEU, the Red Sea surcharge for exports out of the Mediterranean on long term contracts sits higher than North European exports, with a spread of USD 162. However, while the market low for both trades sits at USD 400, the market high sits at USD 1,295 for the Mediterranean and USD 750 for North Europe. Bringing a reefer out of North Europe heading for Far East, the average surcharge sits at USD 1,007 per box.

IMPACTS ON SHIPMENTS/TRAFFIC/CONGESTION

Red Sea diversion routes and durations must be factored in when preparing for peak season (from July-October). According to Sea-Intelligence, the transit times of 20’ containers has increased by 16%. Shipping lines expect longer transit times to last through Q2 and potentially Q3. Blank sailings could be expected into the Red Sea area because of the security situation.

The longer transits around the COGH are delaying the arrival of the empty vessels going back to Asia to pick up more U.S. imports. The delays are impacting the consistency of trade which can impact the supply chain.

Data from maritime advisory firm Sea-Intelligence shows that the average delay for late vessel arrivals has "deteriorated," and as a result, vessel capacity has diminished, with impacts for U.S. East Coast-bound Ocean freight from Asia going around COGH. (Source: https://cnbc.com)

OUTLOOK

We don’t see the Red Sea situation changing any time soon and the above-mentioned trends are likely to continue into H2 2024.

OUR ADVICE

This ongoing crisis will continue to impact rates and increase service unreliability to global supply chains. It is important to stay up to date, book well in advance, potentially look for alternatives and contact us on time to discuss your transport inquiry.

We commend our customers to be flexible in these times of uncertainty. They need to have the ability to enter the North American market from different endpoints, be it the West Coast, Gulf, or the East Coast via vessel or also considering airfreight as alternative transport modes.

We are here by your side to keep your supply chains moving and identifying the most suitable mode and route for your cargo transport. Contact your local Bertling office for further updates: https://www.bertling.com/offices/.