The attacks in the Red Sea, which started in November 2023, have caused widespread disruption to the sea freight industry. The most recent escalation of conflict in the Middle East, the seizing of MSC Aries, was the latest major geopolitical incident to impact supply chains. It is vital to stay updated on the data and market intelligence to be able to make evidence-based decisions in the aftermath of these global events. Our notifications are designed to provide you with an overview of recent events and the associated commercial and operational impacts.

LATEST DEVELOPMENTS

MSC’s vessel Aries has remained seized by Iran’s Revolutionary Guards in the Strait of Hormuz since 13.04.2024, after Tehran vowed to retaliate for a suspected Israeli strike on its consulate in Damascus on 01.04.2024. On 18.04.2024 an Indian woman, a crew member on the container vessel, returned to her home country. The 16 other Indian crew members are still on board, while negotiations continue. (Source: Indian crew member from MSC Aries seized by Iran returns home)

Sixteen commercial maritime industry associations joined together in a letter to the Secretary-General of the UN’s Antonio Guterres calling for action, while saying the current situation where merchant ships and their crews are being targeted is intolerable and unacceptable. They cite that Iran is now holding four commercial vessels (the tankers Advantage Sweet, Niovi, and St Nikolas and now the MSC Aries). The Houthis in addition are holding a fifth vessel, the car carrier Galaxy Leader, and its crew. (Source: Shipping Trade Groups Call on UN to Protect Seafarers)

Explosions echoed over an Iranian city on 19.04.2024 in what sources said was an Israeli attack, but Tehran played down the incident and indicated it had no plans for retaliation - a response that appeared gauged towards averting region-wide war. Iran's foreign minister said the drones, which the sources said Israel launched against the city of Isfahan, were "mini drones" and that they had caused no damage or casualties. (Source: Tehran plays down reported Israeli attacks, signals no retaliation)

Impacts on Ocean Freight Rates

Container shipping

From a purely commercial perspective of container shipping: Service from the Far East to destinations in the Mediterranean Sea, Northern Europe and US East Coast, are running fairly smoothly around the Cape of Good Hope.

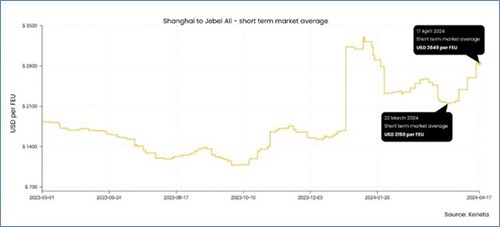

The container shipping spot market freight rate from Shanghai, China to Jebel Ali, UAE has reacted to the recent growing political tensions, increasing by 32% between 22 March 2024 and 17 April 2024 to reach USD 2,849 per FEU. (Source: xeneta.com)

The Xeneta data shows that, not only is Jebel Ali one of the world’s most important ports, but it is also sensitive to geopolitical unrest and conflict.

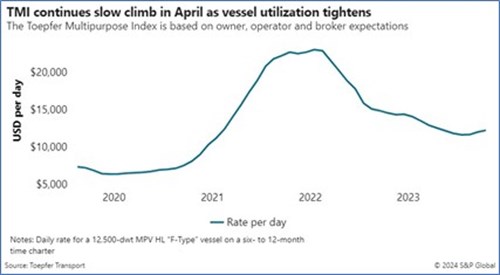

Breakbulk

The ongoing disruptions in the Red Sea and Panama Canal continue to force multipurpose and heavy-lift (MPV/HL) carriers to sail longer routes to maintain their service schedules, modestly boosting rate-based MPV indices in April. Toepfer’s Multipurpose Index (TMI) is expected to tick up 1.93% to USD 12,259 per day this month from March’s USD 12,027 per day. The TMI is down 16% year over year, from April 2023’s average of USD14,595.

While the Red Sea situation remains volatile, we can expect carriers to take evasive action at any time. (Source: Freight Forward: Rates on the Rise)

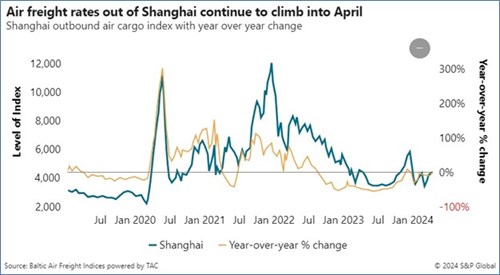

Airfreight

Strong demand for e-commerce from the US and Europe that drove global airfreight cargo volume growth in the first quarter is expected to lead into a “heavy” peak season later this year. However, the airfreight market is heading for a longer-term shortage of capacity and will struggle to accommodate the growing volume. (Source: Freight Forward: Rates on the Rise)

Shippers continue to turn to air cargo due to unreliability in ocean freight services. The market is experiencing a shift in transport mode, this time around the disruption has been caused by ongoing conflict in the Red Sea. Consequently, air cargo demand from Asia and the Middle East to Europe saw a substantial increase, leading to a significant month-on-month rise in airfreight cargo rates in the affected region. Moreover, factors like the Qing Ming festival in China, Ramadan in Muslim countries and the Easter break has affected transshipments via the Middle East.

Also, other recent disruptions, including the floods in the UAE and Kazakhstan and the eruption of Mount Ruang in Indonesia, keep rising the overall interest in airfreight logistics.

SURCHARGES (no changes since last report from 12.03.2024)

Diversions away from the Suez Canal have hit ocean freight trades hard from Asia to the Mediterranean, North Europe and US East Coast. However, it could be argued cargoes moving in the opposite direction on the backhauls have been hit even harder by these surcharges.

Effect – North Europe to Far East.

Moving from USD 400 per FEU by the end of 2023 to more than USD 1,000 per FEU by mid-February, market average spot freight rates have gone up by 150% in six weeks.

Within these market average spot rates, some shippers have been paying upwards of USD 1,000 in additional costs while others have managed to avoid surcharges altogether, with an average of USD 591 per FEU.

Effect – Mediterranean to Far East

Surcharges are spread in the range of USD 400 (mid-low) and USD 1,100 (mid-high) per FEU, with an average of USD 639.

Effect – North Europe to Australia and New Zealand

Shippers and BCOs are paying average surcharges of USD 854 per FEU within a total spot rate of USD 2,400 per FEU. This positions the trade slightly above a classic backhaul and slightly below a classic fronthaul in terms of the total spot rate and percentage of surcharges to overall cost.

Wide-ranging effects

The effects of the crisis are highly individual, and shippers, carriers, and freight forwarders are fighting as hard as they can and entering negotiations with the single aim of reducing the effect of the crisis on their business as much as possible – whether that is through surcharges or service reliability.

Surcharges are more significant on long-term rates

For a standard FEU, the Red Sea surcharge for exports out of the Mediterranean on long-term contracts sits higher than North European exports, with a spread of USD 162. However, while the market low for both trades sits at USD 400, the market high sits at USD 1,295 for the Mediterranean and USD 750 for North Europe. Bringing a reefer out of North Europe heading for Far East, the average surcharge sits at USD 1,007 per box.

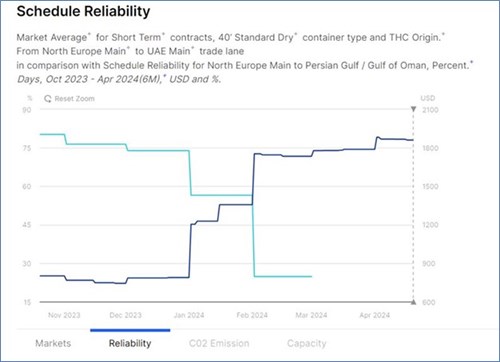

IMPACTS ON SCHEDULE RELIABILITY

The schedule reliability on the North Europe to UAE Main corridor has decreased by 51.57% compared to November 2023. CMA CGM is the most reliable carrier (33.33%) while Maersk is the least reliable (12.73%). The green line below shows the massive drop in reliability in February, which is now flat lining again. (Source: xeneta.com).

In the days following the seizure of MSC Aries, container ships have continued to sail through the Strait of Hormuz, once again demonstrating the resilience of ocean freight container services.

The MSC Aries incident was a targeted attack by Iran against Israeli interests rather than a random hijacking. This is unlike the situation in the Red Sea, where almost any ship is a target

for Houthi militia and perhaps why ships are continuing to sail through the Strait of Hormuz.

(Source: Weekly Container Rate Update l Week 16 '24 l Escalation of conflict in the Middle East)

OUTLOOK

We don’t see the Red Sea situation changing any time soon and the above-mentioned trends are likely to continue into H2 2024.

OUR ADVICE

This ongoing crisis will continue to impact rates and increase uncertainty within global supply chains. It is important to stay up to date, book well in advance and potentially look for alternatives, where available. Please contact us on time to discuss your transport inquiry.

We recommend that our customers try to build in a degree of flexibility in these times of uncertainty. We recognise that this is not straightforward and requires multi-party coordination. We should, where possible and reasonable, consider airfreight as alternative transport mode.

We are here by your side to keep your supply chains moving and help identify the most suitable and economic mode and route for your cargo transport. Contact your local Bertling office for further updates: https://www.bertling.com/offices/.

Stay informed:

For air freight inquiries:

Janine Seemke

Global Head of Airfreight

P: +49 40 32335554M:+49 173 3893139

E: janine.seemke@bertling.com

For sea freight inquiries:

Samuel Semple

Group Pricing Manager – Ocean Freight (FL)

P: +49 40 3233550M:+49 1732069897

E: samuel.semple@bertling.com